Revised ETI Covid-19 Relief Measures

PLEASE NOTE:

These are unprecedented times which may lead to ever-changing information.

The information that follows is up to date at the time of compiling this document and releasing our software Release 5.4c.

Please ensure that you are registered on Sage City to remain updated with any changes and product-specific information.

Please consult Release Notes 5.4b for details regarding relief measures already implemented.

The Ministry of Finance published the first round revised draft Disaster Management Tax Relief Bill and the revised draft Disaster Management Tax Relief Administration Bill on 1 May 2020.

The second round of the revised draft Disaster Management Tax Relief Bill was published on 19 May 2020.

These revised draft Bills provide for relief measures for employers i.r.o the employment tax incentive (ETI), PAYE and SDL.

Although not promulgated yet, these draft Bills provide the necessary legislative amendments required to implement the Covid-19 tax relief measures. These measures contained in the draft Bills will take effect on 1 April 2020, unless mentioned otherwise.

For detailed information regarding the proposed and revised ETI Relief Measures, consult:

‘COVID-19_Relief_Measures_Affecting_Payroll.pdf’ on Sage City.

ETI Conversion and Report

You must have updated to Release 5.4b during your processing period for April.

You MUST have updated to Release 5.4c during your processing period for May.

This sequence will have ensured that ETI recalculations were automatically applied during the conversion process to Release 5.4c.

Please Note:

If you did not follow the sequence as stated above, your ETI values will need to be amended manually and will require a consultant’s assistance.

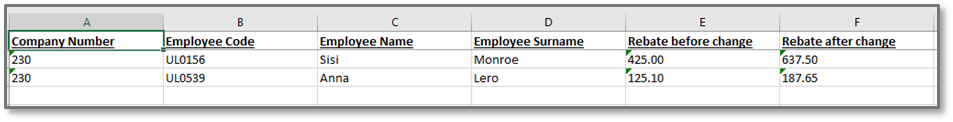

Employees who have ETI values that have been recalculated during conversion for April are listed on the ETI COVID Report found on:

Main Menu > Reports > Audit Reports > ETI COVID Report

If the report does not download automatically, you will need to manually start the download.

The report will open in Excel and reflect the value before the recalculation and the values after the ETI recalculation for all employees with changes.

Please Note:

Use this report to determine who has been recalculated and to confirm you agree with the recalculated values.

Revised Relief Measures

The R2000 wage for a full month (i.e. at least 160 employed and remunerated hours) will not apply to employees for the period 1 May 2020 – 31 July 2020, where the employer is taking advantage of the ETI COVID-19 relief measures (registered for employee’s tax on or before 25 March 2020). The wording, ‘higher of’, has been removed.

|

Minimum wage test before May and after July |

Minimum wage test from 1 May – 31 July |

|

- The minimum rate per hour as specified by the wage regulating measure, or - The minimum rate per hour as specified in the National Minimum Wage Act.

|

All employees must be linked to a Minimum Wage Code and the Wage Regulating Measure/National Minimum Wage must be selected (ticked) on the Employee ETI Tab.

If not – NO ETI will calculate for the period 1 May – 31 July 2020.

Refer to R5.4a Release Notes for detailed steps on how to create the Minimum Wage Code and on activating the Wage Regulation Measure/National Minimum Wage flag.

If an employee is employed and remunerated for less than 160 hours in a month, no remuneration gross-up will be done to 160 hours and the actual remuneration will be used in all cases (irrespective of amount of employed and remunerated hours).

Effective from 1 May 2020 – 31 July 2020 for employers who are registered for employee’s tax on or before 25 March 2020.

Example:

|

|

Before May 2020 (and after July 2020) |

From 1 May 2020 – 31 July 2020 |

|

Actual remuneration for the month |

R2600 |

R2600 |

|

Employed and remunerated hours for the month |

130 |

130 |

|

Monthly remuneration used to calculate the ETI amount |

R3200 (R2600 / 130 x 160) – gross up required since employed and remunerated hours are less than 160 |

R2600 (no gross up required for this period) |

It is still required from employers to capture/indicate the ‘employed and remunerated’ hours i.r.o remuneration (ordinary/contractual, unpaid and additional hours) but just for this three-month period, remuneration should not be grossed-up (irrespective of employed and remunerated hours value).

However, the employed and remunerated hours will still be used to pro-rata the ETI amount.

The Gross-up of remuneration will be determined by the ETI Table that is applied.

Effective date: 1 April 2020 – 31 July 2020

The ‘date of engagement’ qualifying criteria of ‘employed on/before 1 October 2013 by the employer or associated person’ has been removed.

Therefore, the following groups of people will qualify for additional ETI.

-

Columns 1 and 2 (refer to ETI Table below):

- Qualifying employee aged 18 to 29 years old on the last day of the calendar month who was employed on or after 1 October 2013 .

- Qualifying employees who qualify according to the SEZ criteria, irrespective of date engaged.

-

Column 3 (refer to ETI Table below):

- Qualifying employee aged 18 to 29 years old on the last day of the calendar month who was employed on or after 1 October 2013 who has qualified 24 times.

- Qualifying employee who qualifies according to the SEZ criteria (irrespective of date of engagement) who has already qualified 24 times.

-

Qualifying employee aged 18 to 29 years old on the last day of the calendar month who was employed before 1 October 2013.

-

Qualifying employee aged 30 to 65 years old on the last day of the calendar month (irrespective of date of engagement).

Please see ‘ETI table’ for more information.

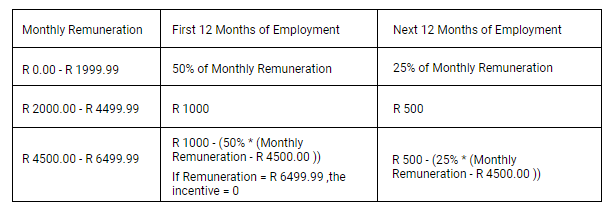

The Employment Tax Incentive Table has been amended to accommodate the Additional ETI Relief.

The Employee ETI History Screen

(Main Menu > Payroll > Payslip Information > Select Employee > Click on <ETI>)

displays the ETI Table before the ETI Relief Measures were introduced.

The ETI Relief Measures table is found on the <ETI Calc Info> document, at the bottom of this Screen.

The table on the Employee ETI History Summary Tab has remained unchanged and is applicable:

-

from 1 January 2020 – 31 March 2020,

-

in companies where the Additional ETI Relief tick has not been flagged on the ETI Company Setup Screen, and

-

from August 2020.

The <ETI Calc Info> document is found at the bottom of this screen.

Latest ETI Table, valid from 1 April 2020 to 31 July 2020, which is part of this release:

|

Monthly remuneration |

First 12 months |

Next 12 months |

Months exceeding 24 months/employed before 1 October 2013/30–65 years of age |

|

Apply to:

|

-Qualifying employees aged 18 to 29 years old employed on/after 1 October 2013, or -qualifying employees who qualify according to the SEZ criteria, irrespective of date engaged |

-Qualifying employees aged 18 to 29 years old employed on/after 1 October 2013, or -qualifying employees who qualify according to the SEZ criteria, irrespective of date engaged |

-Qualifying employee aged 18 to 29 years old who was employed on/after 1 October 2013 and has qualified 24 months, or -or an employee who qualifies according to the SEZ criteria, irrespective of date engaged, who have already qualified for 24 months, or -Qualifying employee aged 18 to 29 years old who was employed before 1 October 2013, or -qualifying employees aged 30 to 65 years old, irrespective of date engaged. This column is only valid from 1 April 2020 to 31 July 2020 |

|

R0 – R1 999.99 |

87.5% of monthly remuneration |

62.5% of monthly remuneration |

37.5%of monthly remuneration |

|

R2 000 – R4 499.99 |

R1 750 |

R1 250 |

R750 |

|

R4 500 – R6 499.99 |

Formula: R1 750 -(87.5% x (monthly remuneration – R4 500)) |

Formula: R1 250-(62.5% x (monthly remuneration – R4 500)) |

Formula: R750 - (37.5% x (monthly remuneration – R4 500)) |

Adjustments to April while in Processing Period for May (applicable for employers registered for PAYE before/on 25 March 2020 making use of the additional ETI relief measures):

The values for April values will be amended (recalculated during the conversion process) according to the new table, and considering the:

-

Gross-up of remuneration if employed and remunerated hours are less than 160.

-

ETI amounts for column 1, 2 (first 24 months) and 3 will be pro-rated if employed and remunerated hours are less than 160.

-

New ‘date of engagement’ qualifying criteria will be applied.

The amended/recalculated value for April can either be more of less than the original ETI value for April.

If the amended value is more, the additional amount for April may be claimed on any EMP201 in this 6-month reconciliation period, i.e. May to August 2020.

If the amended value is less, then the April EMP201 must be restated to reflect the lessor value.

Calculations for May, June and July (applicable for employers registered for PAYE before/on 25 March 2020 making use of the additional ETI relief measures):

-

R2000 minimum Wage Test. If an employee is not linked to a Minimum Wage Code and Wage Regulating Measure is not selected (ticked) for April, ETI values will be cleared.

-

There will be no Gross-up of remuneration if employed and remunerated hours are less than 160.

-

ETI amounts for column 1, 2 (first 24 months) and 3 (more than 24 months/employed before 1 October 2013/30-65 years old) will be pro-rated if employed and remunerated hours are less than 160. Therefore, it is vital that the ‘employed and remunerated hours’ (ordinary/contractual, unpaid and additional hours) be captured/indicated in the system for all employees to ensure the correct ETI calculation is applied.